Fed's Yellen more complex than dove label implies

I think her appointment was the best choice for US macro economy.

Fed's Yellen more complex than dove label implies| Reuters: "Yellen's name is inevitably mentioned among the Fed's most dovish members, or those more likely to favour lower interest rates to support economic growth and boost labour markets."

Treasury Auctions Set for This Week - Schedule

Treasury Auctions Set for This Week - Schedule - NYTimes.com: "The Treasury’s schedule of financing this week includes the regular weekly auction of new three- and six-month bills on Monday, and an auction of four-week bills on Tuesday."

Hungary Forint Flirts With Old Range vs. EUR - XpatLoop.com - Business & finance

Hungarian forint has been robust during the seasons "so called crises" and their economy strength shows in the bond market.

Greek Bonds Advance After European Leaders Back Rescue Plan

Spreads between Greek bonds and German bunds tightened, as a relief reaction that a deal has been reached among EU nations.

アルゼンチン、債務スワップに関する有価証券届出書を関東財務局に提出

アルゼンチン、債務スワップに関する有価証券届出書を関東財務局に提出

| Reuters: "アルゼンチン政府は25日、日本で債務不履行に陥ったソブリン債のスワップ計画の条件を関東財務局に提出"

| Reuters: "アルゼンチン政府は25日、日本で債務不履行に陥ったソブリン債のスワップ計画の条件を関東財務局に提出"

FAPRI Says Economic Turnaround Will Fuel Crop Price Recovery

WTI oil future price is in a random walking at 80$ per a barrel at the moment.But if oil price is pressured upside momentum lead by strong demands from Asia,the price would be beyond 100$ with no wonder.So Who`s gonna survive?

Wallaces Farmer - FAPRI Says Economic Turnaround Will Fuel Crop Price Recovery: "The economic recovery will be accompanied by projected stronger energy prices. The FAPRI economists expect that the continuing recovery of crude oil prices along with bioenergy mandates will grow the demand and strengthen the world price of ethanol through 2019. Global net trade in ethanol is projected to increase by 3.12 billion gallons and reach 4.15 billion gallons by 2019."

India faces more rate hikes to tame inflation

India faces more rate hikes to tame inflation: Analysts- Indicators-Economy-News-The Economic Times: "RBI looks set to tighten monetary policy further after raising interest rates for the first time in nearly two years as it bids to check Burst the Inflation balloon

Implications of a rising inflation rate

spiralling inflation, economists say.

In a move that surprised experts, the Reserve Bank of India (RBI) hiked short-term rates from record lows late Friday to battle near double-digit annual inflation amid fast-strengthening industrial output.

Expectations had been for a rate hike at the bank's scheduled policy review on April 20 but the RBI said in a statement that inflation had 'been a source of growing concern.'

The wholesale price index (WPI) in Asia's third-largest economy was 9.89 percent in February, well above the central bank's own estimate of 8.5 per cent by the end of the current financial year this month.

On Friday, the RBI raised the repo, the rate at which it lends to commercial banks, by 25 basis points to 5.0 per cent."

Teva to buy Ratiopharm for nearly $5 bln |

Israel drugmakers are having a strong competitiveness in that sector.

| Reuters: "Israel's Teva (TEVA.TA) (TEVA.O) won the battle for generic drugmaker Ratiopharm, paying 3.7 billion euros ($5.1 billion) to fix its weakness in Germany, the world's second-largest generics market."

Argentine economy expanded or contracted in 2009?

MERV(Argentina stock index) vs BSVP(Brazil) vs (Mexico)

Guessing time: Argentine economy expanded or contracted in 2009? — MercoPress: "Argentina's government expects the economy to grow 2.5% in 2010, according to its budget proposal. That compares to official forecasts of 6% growth in Brazil, Latin America's largest economy and 3.9% in Mexico, the region's second largest economy.

Argentina's growth and industrial output data releases were accompanied on Friday by additional financial information from the government.

The primary budget surplus narrowed to 1.21 billion pesos (310 million USD) in February from 1.60 billion pesos reported in February 2009. Tax income growth has slowed as Argentina's economy tries to pull out of the 2009 slowdown caused in part by the world financial crisis.

The government faces about 15 billion USD in debt payments this year as it seeks regulatory approval to reopen the country's 2005 debt restructuring. Argentina hopes to re-enter the international capital markets once it restructures 20 billion in paper left over from the country's 2001/2002 debt default."

Argentina industry output jumps on Brazil demand

Argentina economy looks expanding with Brazilian domestic consumptions.

| Reuters:

"* 11 pct industrial output rise blows past market view

* Car exports to Brazil help keep production healthy"

* Car exports to Brazil help keep production healthy"

Finance Bonds Pull Ahead as JPMorgan Sells Debt: Credit Markets

Some people see those attractive.

Finance Bonds Pull Ahead as JPMorgan Sells Debt: Credit Markets - BusinessWeek: "Debt sold by banks, insurers and brokers returned 0.81 percent this month through yesterday, compared with 0.4 percent for the rest of the market, according to Bank of America Merrill Lynch index data. The cost to borrow for banks is the lowest since February 2008, with yields falling to within 1.93 percentage points of Treasuries on March 18."

Finance Bonds Pull Ahead as JPMorgan Sells Debt: Credit Markets - BusinessWeek: "Debt sold by banks, insurers and brokers returned 0.81 percent this month through yesterday, compared with 0.4 percent for the rest of the market, according to Bank of America Merrill Lynch index data. The cost to borrow for banks is the lowest since February 2008, with yields falling to within 1.93 percentage points of Treasuries on March 18."

2010年の半導体支出は2けた成長の見込み

2010年の半導体支出は2けた成長の見込み--米調査:ニュース - CNET Japan: "OEM(Original Equipment Manufacturer)による2010年の半導体支出は、前年比で13%と大幅に増加し、1779億ドルになると予測されている。一方、EMS(Electronic Manufacturing Service)プロバイダによる2010年の支出は、前年比15.1%増の377億ドルになる見込み。"

Bank of Canada sees low rates, but not copying Fed | Business | Reuters

Bank of Canada sees low rates, but not copying Fed

| Business

| Reuters: "The Bank of Canada believes interest rates should stay at near-zero levels for another few months even though the economy is showing signs of quicker than expected recovery, the central bank chief said on Thursday.

At the same time, Bank of Canada Governor Mark Carney said there was no need for Canada to align its interest rate moves with those of the United States, as speculation grows that Ottawa could start removing emergency stimulus measures before Washington does."

| Business

| Reuters: "The Bank of Canada believes interest rates should stay at near-zero levels for another few months even though the economy is showing signs of quicker than expected recovery, the central bank chief said on Thursday.

At the same time, Bank of Canada Governor Mark Carney said there was no need for Canada to align its interest rate moves with those of the United States, as speculation grows that Ottawa could start removing emergency stimulus measures before Washington does."

Subscribe to:

Posts (Atom)

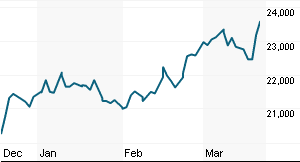

Nikkei225

28000-28550 up in the early session, down lately.

-

まず、米ドルの反対にある欧州単一通貨ユーロを考えることが米ドルの過去、未来を探るのに相応しいため、ユーロ・ドルの展望してみる。 本来ならば、ドル・円でと考えたが、ご承知のとおり、日本株、日本国債、日本外為市場などの東京市場は外国人から見れば、超巨大なローカル市場にすぎない。また、...

-

ECBによる資金供給や公的資金の投入が奏功し、欧州金融機関の融資余力が増しているようだ。 source- nikkei net

-

28000-28550 up in the early session, down lately.