ドルインデックス

Yen sell off?

there’s less fear,then VIX down

carry play?

The successful auction in USA

"The third tranche of US Treasury auctions did not quite match the upbeat results from the previous two, but was broadly in line with market expectations. The bid/cover ratio for the $26 bln worth of 7-year notes on offer was 2.26 times (YTD average 2.3 times) while indirect participants soaked up 33% of the issuance. US bond yields were very much in the spotlight again overnight, recouping some of the losses from the previous session with the 10-year yield dipping 11bp to 3.61%.

In the wake of the successful auction this week, Fed’s Fisher, a non-voting member of the FOMC this year, squashed the recent market chatter that there had been continued demand from foreign central banks for longer-term maturities and this was borne out by the auction results. He also maintained his more cautious approach to the economic outlook, reiterating his view that the unemployment rate could reach 10%. Following his recent visit to China, he also commented that there was little evidence that China wants to significantly shift its dollar portfolio, adding that China had no desire to harm the US’ financial markets as the interests of both parties were inter-connected. As an aside, note that this morning South Korea’s National Pension Fund said would reduce its exposure to US bonds and diversify onto other assets. However, the Pension Fund’s current holdings of US bonds account for 83% of its foreign bond holdings which only total $8.5 bln. Fisher also believed that the US’ coveted AAA rating, which has grabbed a few headlines of late, was not at risk of a downgrade and attributed the recent steepening in the yield curve to possibly supply concerns but also on increased confidence towards the economy." source-saxo bank

EUR/USD

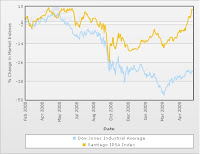

Chile stock market VS U.S. Dow Jones industrial average

I turn to see the U.S cooprate bonds market

GMに破産法適用か

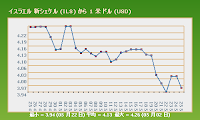

イスラエルの通貨防衛

米財務省証券入札への高い関心

The surge in distressed loans in South korea

Brazil intevend to the currency market

The U.S.dollar declined the lowest level in 2009

China picks up more U.S. short term bills less long term bonds

- The inflation would come in America.

- U.S.dollar less valued.

- After the world economy shrinked,Chinese government`s foreign reserve have decreased.

- for a rapid growth in domestic market, they needs the commodities related deserve(particularly in gold). -related articles

欧州版ストレステスト

Curde oil continued up on the NYME

As long as the u.s. dollar weakness continued and the stock market sentiment is in good mood from the worst time, the oil future slides to rise in New York.

ホクトが最高益

日本ガイシ

Hungarian Forint Recovered(1)

India buying

risk aversion

ユーロの巻き戻し(2)

ユーロの巻き戻し

china economy

currencies,stocks up and bonds outperformed.

Fund managers say debt markets still lack buyers

the world’s second-best performing major currency this year.

Brazil’s real rose for the first time this week on speculation higher stock prices and increased demand for commodities will sustain gains for the world’s second-best performing major currency this year.

The real climbed 1.3 percent to 2.0867 per U.S. dollar at 4:05 p.m. New York time.

source-bloomberg

The yen fell against the euro

as a gain in stocks encouraged investors to buy higher-yielding assets funded with Japan’s currency.

Banks’ costs to borrow yen for three months fell to a two- year low of 0.54 percent in London, less than half the amount for similar-maturity euro loans, according to the British Bankers’ Association.

source-bloomberg

日経商品指数42種

<日経商品指数42種の構成品目の区分>鋼材、非鉄金属、繊維、木材、化学、石油製品、紙、食品、その他

日経商品指数42種の主な構成品目

繊 維、綿糸、アクリル糸、ナイロン糸鋼 材棒鋼、山形鋼、H形鋼非 鉄銅地金、アルミニウム地金、黄銅丸棒木 材ヒノキ正角、合板、米ツガ正角化 学カセイソーダ、ポリプロピレン、塩化ビニール樹脂石 油ガソリン、軽油、C重油紙・ 板紙古紙、上質紙、段ボール原紙食 品砂糖、大豆、大豆油その他セメント、天然ゴム

Buy Commodities, Sell Treasurys

Pampa Energia

ECB「量的緩和」へ

US Nonfarm payroll employment

stress-test results table

| Bank | Ticker | Total assets | Market value | Worst-case loss estimate | Capital needed |

|---|---|---|---|---|---|

| Bank of America | BAC | $1.6 trillion | $86.5 billion | $136.6 billion | $33.9 billion |

| Wells Fargo | WFC | $1.1 trillion | $105.1 billion | $86.1 billion | $13.7 billion |

| GMAC1 | N/A | $172.7 billion | $225 million | $9.2 billion | $11.5 billion |

| Citigroup | C | $996.2 billion | $21 billion | $104.7 billion | $5.5 billion |

| Regions Financial | RF | $116.3 billion | $3.6 billion | $9.2 billion | $2.5 billion |

| SunTrust | STI | $162 billion | $6.6 billion | $11.8 billion | $2.2 billion |

| Morgan Stanley | MS | $310.6 billion | $29.4 billion | $19.7 billion | $1.8 billion |

| KeyCorp | KEY | $106.7 billion | $3.4 billion | $6.7 billion | $1.8 billion |

| Fifth Third Bancorp | FITB | $112.6 billion | $3.1 billion | $9.1 billion | $1.1 billion |

| PNC | PNC | $250.9 billion | $19.8 billion | $18.8 billion | $600 million |

| JPMorgan Chase | JPM | $1.3 trillion | $132.4 billion | $97.4 billion | $0 |

| Goldman Sachs | GS | $444.8 billion | $67.3 billion | $17.8 billion | $0 |

| MetLife | MET | $326.4 billion | $26 billion | $9.6 billion | $0 |

| U.S. Bancorp | USB | $230.6 billion | $34.4 billion | $15.7 billion | $0 |

| Bank of New York Mellon | BK | $115.8 billion | $34 billion | $5.4 billion | $0 |

| State Street | STT | $69.6 billion | $16.4 billion | $8.2 billion | $0 |

| Capital One Financial | COF | $131.8 billion | $10.4 billion | $13.4 billion | $0 |

| BB&T | BBT | $109.8 billion | $14.2 billion | $8.7 billion | $0 |

| American Express | AXP | $104.4 billion | $30.3 billion | $11.2 billion | $0 |

Nikkei225

28000-28550 up in the early session, down lately.

-

ECBによる資金供給や公的資金の投入が奏功し、欧州金融機関の融資余力が増しているようだ。 source- nikkei net

-

今日の予想 30000円ー29780円

.gif)