日米財政赤字

翻って、米国も最悪。3.7トリオン米ドルの財政赤字拡大路線。

両政府とも、不況の中厳しい財政政策が要求されている。

sourece-読売、

CIT Presses U.S. Regulators for Aid -bloomberg

goldman sachs and CIT group

Is US economy growth without employment?

The current plunge is structural, not cyclical. Most of the jobs lost will never come back. The real estate bubble severely distorted the economic structure. Now the world economy has a lot of rebalancing to do. And this process will last much, much longer than the “green shoots” crowd deems possible.

My suggestion for you today is to watch the stock market for hints of the beginning of the next stage of this crisis. Watch unemployment and world trade as reliable indicators of the severity of the slump. And then watch California to get a feel for the next important act of this economic and financial drama: The government funding crisis and all its related repercussions. "

- It`s ok if US economy and the stock prices are going up led by competitive world leading companies along with the world economies showing bright sign, but as long as deepen unemployment concerns occur serious social problems.

- Deleverging in household sectors means less consumptions,not easy situations for job seeker less consumption.

- The low Credit small-mid sized companis will face more difficutlies to find credit line,because it has been seen Japan for the bankers they invest to the bonds market rather than lend money to companies. Its easy way.

- The cash is king!!!!

中国、資産バブルか?

今年度上半期ですでに中国国内での融資増加額は7兆元(約100兆円)を超え、すでに2008年の通年実績の1.4倍に達した。ほとんどは株式や不動産に流れ込んで資産バブルの懸念。先進国経済\の落ち込みが激しい中で輸出が伸び悩み景気に先行き不安が残る。

中国政府は金融危機対応の緊急措置を終わらせる「出口戦略」に苦慮している模様。

China Needs to Keep Reining in Loans, Researcher Says

World Dollar

Central banks moved this week

- Peru central bank cut key interest rate 100 basis points to 3% source-bloomberg

ECB keep the interest rate

4 June 2009 - Monetary policy decisions

At today’s meeting the Governing Council of the ECB decided that the interest rate on the main refinancing operations and the interest rates on the marginal lending facility and the deposit facility will remain unchanged at 1.00%, 1.75% and 0.25% respectively.

source-ECB

ECB Purchase programme for covered bonds

ECB Purchase programme for covered bonds

Following-up on its decision of 7 May 2009 to purchase euro-denominated covered bonds issued in the euro area, the Governing Council of the European Central Bank (ECB) decided upon the technical modalities today. These modalities are as follows:

The purchases, for an amount of EUR 60 billion, will be distributed across the euro area and will be carried out by means of direct purchases.

The purchases will be conducted in both the primary and the secondary markets.

In order to be eligible for purchase under the programme, covered bonds must:

be eligible for use as collateral for Eurosystem credit operations;

comply with the criteria set out in Article 22(4) of the Directive on undertakings for collective investment in transferable securities (UCITS) or similar safeguards for non-UCITS-compliant covered bonds;

have, as a rule, an issue volume of about EUR 500 million or more and, in any case, not lower than EUR 100 million;

have, as a rule, been given a minimum rating of AA or equivalent by at least one of the major rating agencies (Fitch, Moody’s, S&P or DBRS) and, in any case, not lower than BBB-/Baa3; and

have underlying assets that include exposure to private and/or public entities.

The counterparties eligible to the purchase programme are those eligible for the Eurosystem’s credit operations, as well as euro area-based counterparties used by the Eurosystem for the investment of its euro denominated portfolios.

The purchases will start in July 2009 and are expected to be fully implemented by the end of June 2010 at the latest.

source-ECB

良い金利上昇か、悪い金利上昇か

- 健全な景気回復 55%

- デフレーション 25%

- スタグフレーション 10% と言ったところか。

Bundesbank President said

欧米金融機関、融資態度厳格

米国景気、行き過ぎた債務過剰が負担

欧州、長期金利上昇圧力高まる

ドイツ、新規国債発行額476億ユーロへ

Researchers say U.S.dollar overvalued

U.S.dollar rebound

政府、米の減反を見直しへ

ロシア、IMF債購入へ一番乗りか

GM,破産法手続きは時間との勝負

Bulgarian banking system sees no problems

ドルインデックス

Yen sell off?

there’s less fear,then VIX down

carry play?

The successful auction in USA

"The third tranche of US Treasury auctions did not quite match the upbeat results from the previous two, but was broadly in line with market expectations. The bid/cover ratio for the $26 bln worth of 7-year notes on offer was 2.26 times (YTD average 2.3 times) while indirect participants soaked up 33% of the issuance. US bond yields were very much in the spotlight again overnight, recouping some of the losses from the previous session with the 10-year yield dipping 11bp to 3.61%.

In the wake of the successful auction this week, Fed’s Fisher, a non-voting member of the FOMC this year, squashed the recent market chatter that there had been continued demand from foreign central banks for longer-term maturities and this was borne out by the auction results. He also maintained his more cautious approach to the economic outlook, reiterating his view that the unemployment rate could reach 10%. Following his recent visit to China, he also commented that there was little evidence that China wants to significantly shift its dollar portfolio, adding that China had no desire to harm the US’ financial markets as the interests of both parties were inter-connected. As an aside, note that this morning South Korea’s National Pension Fund said would reduce its exposure to US bonds and diversify onto other assets. However, the Pension Fund’s current holdings of US bonds account for 83% of its foreign bond holdings which only total $8.5 bln. Fisher also believed that the US’ coveted AAA rating, which has grabbed a few headlines of late, was not at risk of a downgrade and attributed the recent steepening in the yield curve to possibly supply concerns but also on increased confidence towards the economy." source-saxo bank

EUR/USD

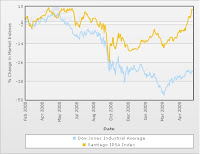

Chile stock market VS U.S. Dow Jones industrial average

I turn to see the U.S cooprate bonds market

GMに破産法適用か

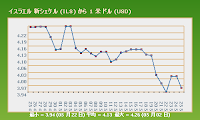

イスラエルの通貨防衛

米財務省証券入札への高い関心

The surge in distressed loans in South korea

Brazil intevend to the currency market

The U.S.dollar declined the lowest level in 2009

China picks up more U.S. short term bills less long term bonds

- The inflation would come in America.

- U.S.dollar less valued.

- After the world economy shrinked,Chinese government`s foreign reserve have decreased.

- for a rapid growth in domestic market, they needs the commodities related deserve(particularly in gold). -related articles

欧州版ストレステスト

Curde oil continued up on the NYME

As long as the u.s. dollar weakness continued and the stock market sentiment is in good mood from the worst time, the oil future slides to rise in New York.

ホクトが最高益

日本ガイシ

Hungarian Forint Recovered(1)

India buying

risk aversion

ユーロの巻き戻し(2)

ユーロの巻き戻し

china economy

Nikkei225

28000-28550 up in the early session, down lately.

-

まず、米ドルの反対にある欧州単一通貨ユーロを考えることが米ドルの過去、未来を探るのに相応しいため、ユーロ・ドルの展望してみる。 本来ならば、ドル・円でと考えたが、ご承知のとおり、日本株、日本国債、日本外為市場などの東京市場は外国人から見れば、超巨大なローカル市場にすぎない。また、...

-

ECBによる資金供給や公的資金の投入が奏功し、欧州金融機関の融資余力が増しているようだ。 source- nikkei net

.gif)